CAT Stock Analysis: Your Ultimate Guide to Investing Success

Heavy Machinery, Heavier Returns: CAT Stock Insights

What factors should be considered in Caterpillar stock analysis?

When analyzing CAT stock, one of the leading industrial companies on Wall Street, consider factors like company performance, industry trends, financial ratios, and market conditions. Look into EVA margin, revenue growth, competition analysis, and any unique selling points of the company to make informed investment decisions in stock analysis.

Company Overview

Caterpillar, often called "Cat," is a heavy machinery behemoth specializing in construction, mining, and agricultural equipment. From bulldozers to excavators, their yellow machines are ubiquitous on job sites worldwide, symbolizing durability and reliability. Competing in the heavy equipment industry, Caterpillar faces formidable opponents like Komatsu and Deere & Company, constantly innovating to stay ahead of the pack. Despite economic fluctuations impacting sectors like construction and mining, Caterpillar has weathered storms with its global presence and diversified product offerings.

Company Outline

Brief information about Caterpillar, CAT stock analysis

Caterpillar Inc. produces machinery and equipment for the construction and mining industries. The company operates through five segments: Construction, Resources, Energy and Transportation, Financial Products, and All Others.

The Construction Industries segment offers a range of products, including compactors, excavators, and tractors, while the Resource Industries segment provides machinery for mining and quarrying. The Energy & Transportation segment offers products and solutions for oil and gas, power generation, marine, rail, and industrial applications.

The Financial Products segment offers financing solutions and insurance products for Caterpillar machinery and equipment. The All Other segment provides integrated logistics solutions and distributes filters, fluids, undercarriage, ground-engaging tools, and precision seals.

Caterpillar Inc. was established in 1925 and is headquartered in Irving, Texas.

You can follow Caterpillar's short story visually at the following link: How Big is Caterpillar?

Sector and Competitors' view

Which sector does it operate in, and against which competitors

Caterpillar has an excellent current (80,7) and above-average performance compared to its sector peers in the past (3Y avg.: 71,4; 5Y avg.: 52,9). It also ranks highly in EVA Momentum, EVA Margin, and Sales Growth Rate. What is EVA?

Caterpillar is in the Industrial GICS Sector within the Machinery GICS industry. Its competitors include Deere & Co. (DE), Paccar (PCAR), and Terex Corp. (TEX).

Compared to its sector peers, it is a top-tier company in terms of performance score. Looking at the factors separately, it can also be said that it performs above the average of its sector peers in terms of EVA Margin (89.7), EVA Momentum (73.6), and Sales Growth Rate (78.7).

Perspective and Competitive Edge

Prospects and the economic moats of the business

Shortly - objective perspective

Caterpillar is a top global company manufacturing heavy machinery products, including construction, mining, energy, and transportation equipment. The company aims to achieve operational excellence, expand customer offerings, and provide value-added services. Caterpillar has reduced structural costs and its fixed asset base in the past decade and released new products, including upgrades to its mining equipment line. The company offers services like machine maintenance and access to aftermarket parts. Its digital applications allow customers to interact with dealers, manage their fleet, and track machine performance.

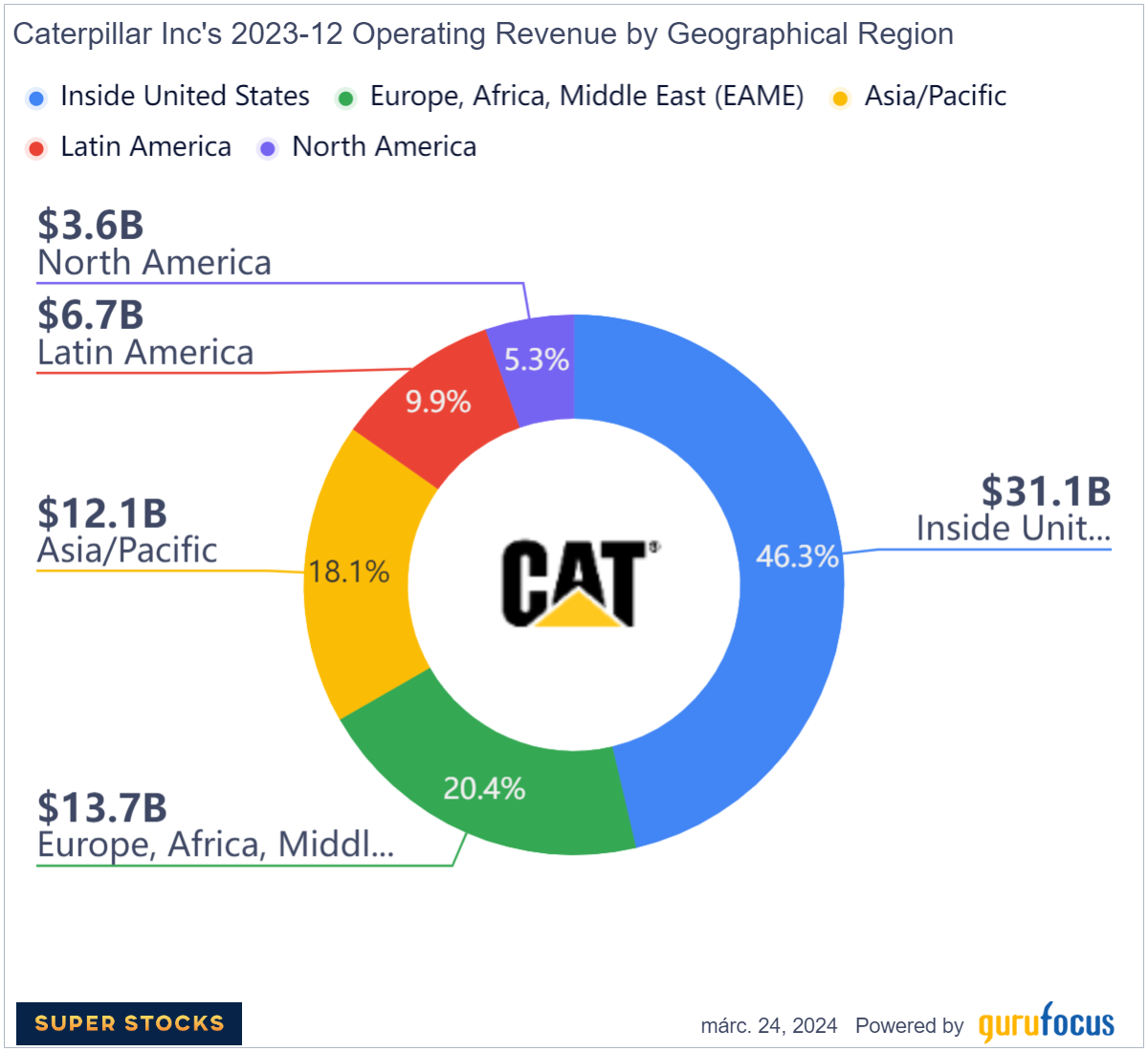

The revenue distribution is well diversified across business segments and geographical regions. It's better to have revenue from multiple segments and a wider geographic spread, as it helps reduce the risk for the company and investors.

Moatology - what the moat is based on the machinery company

Caterpillar is a market leader in heavy machinery equipment, known for providing high-quality and reliable products with the lowest total cost of ownership. Its extensive dealer network and strong brand have solidified its position in the market.

The company's strategy of launching new offerings that cater to customer needs by segment has led to developing high-quality products that customers value, strengthening its brand and competitive positioning.

Caterpillar's products are categorized into lifecycle performance, lifecycle value, and utility. These products offer a wide range of value propositions based on customer type.

Caterpillar focuses on offering products with the lowest total cost of ownership, which considers both purchase and future costs. Customers come for the best products in the industry and the company's ability to provide aftermarket parts on demand and services to keep machines running.

Overall, Caterpillar stands out in the heavy machinery industry by offering some of the most reliable, high-quality, and efficient products.

Caterpillar's SEM brand serves utility customers in emerging markets. They offer low-feature products designed for cost-conscious customers. In contrast, developed markets look for machines that help minimize future costs.

Caterpillar offers many fuel-efficient products that address concerns about carbon emissions. New product models allow customers to complete jobs faster.

Caterpillar's extensive dealer network delivers high-quality products and reliable product support, which keeps customers from switching. Customers invest significant time and money into machinery.

Caterpillar's aftermarket parts and reliable services ensure that its equipment operates efficiently, saving customers from the headache of machine downtime and the need to search for parts independently.

Performance

Evaluation of economic performance

The Performance Score is calculated as the arithmetic average of 3 factors: EVA Momentum, EVA Margin, and Sales Growth Rate. The values of these factors are based on percentile rankings among S&P 500 companies.

EVA Momentum represents the pace of EVA production, EVA Margin represents the ratio of EVA produced to sales, and Sales Growth Rate represents Year over Year sales growth.

Caterpillar’s Performance Score of 80.7 is excellent. It ranks 27th among companies with a wide moat in the S&P 500.

EVA Margin (89,7) alone is outstanding, but EVA Momentum (73,6) and Sales Growth Rate (78,7) are also in the range of the 75th percentile. Current scores are up from both the 3-year average and the 5-year average, so the trend is also positive.

Conjecture and hesitancy

Factors threatening the activity of the machinery giant

Caterpillar stock's most significant risk is declining investment in mining capital expenditures. The company's exposure to coal, iron ore, copper, and gold makes it vulnerable. The company is developing next-gen products that reduce carbon emissions to mitigate risks associated with carbon emissions regulation. Caterpillar faces product safety issues, but the effect of climate change initiatives will be incremental.

New oil wells on federal lands pose a threat, not those on private lands where shale firms operate. Caterpillar faces competition from foreign rivals, mainly Komatsu and Chinese companies like Sany and Zoomlion. Caterpillar will need to enhance product efficiency in response continually.

The U.S. infrastructure deal and strong demand for new roads in emerging markets will benefit Caterpillar in the short term. However, during slow economic periods, investment in construction spending can quickly reverse, leading to weaker capital returns for the company.

Capital usage and resharing

Use and reallocation of capital, investments, and dividend

Caterpillar has a stable financial position with manageable debt and credit lines. Its financing arm supports customers and dealers in facilitating sales. The company focuses on expanding its product portfolio and improving key metrics like revenue and profitability through acquisitions and organic growth. Management has added value through cost reductions, efficiency improvements, and lean manufacturing. The company is investing in digital applications to increase adoption rates, manage fleets, predict maintenance, and lower the total cost of ownership.

Returning cash to shareholders

Caterpillar is committed to increasing dividends every year, even during economic downturns. Share repurchases have varied based on the state of the global economy. Management aims to return almost all its free cash flow to shareholders throughout the economic cycle.

Valuation synopsis

Value assessment from multiple perspectives, CAT stock price forecast from Tipranks analysts

According to Tipranks, 18 Wall Street analysts forecast price targets, and the share price is roughly 12% higher than the average analyst expectation.

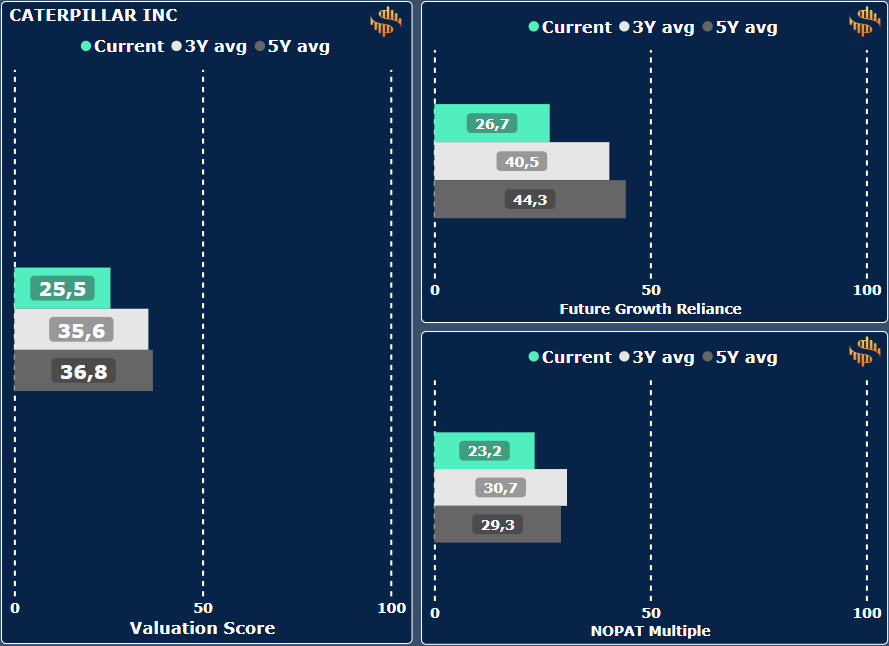

The Valuation Score is the arithmetic average of two factors: NOPAT Multiples, which shows the ratio of NOPAT to Market Value generated, and Future Growth Reliance, which shows the future expectation incorporated in the share price.

While the Performance Score reflects positively on the company, the Valuation Score seems comparatively lower and has a declining trend. It is in the lower region compared to the overall market. This suggests that the company's perception of the future can be described as moderate.

Short & Sweet

Preliminary assessment based on the complete picture

The company's performance is solid and looks assured for the future, thanks to the competitive advantage gained, switching costs, and intangible assets. Future market expectations are less optimistic, perhaps exaggerated, but the company looks like a solid investment opportunity.

Based on current values, Caterpillar is 79th in the Super Stocks Score rankings.

The Super Stocks Score, shown above the EVA Radar, is the average percentile score of the five factors used and presented in the analysis. Companies in the S&P500 are ranked on a scale of 0-100 in each of the five categories based on their actual performance, and the company with the highest Super Stocks Score is considered the best in the market based on performance, growth, and future expectations. For more information, see the Glossary and the forthcoming EVA series.

Help and more information to understand the concepts: Glossary.

Link to: Disclaimer

The Super Stocks Newsletter is provided for general information only. It should not be construed as an invitation or offer to purchase or sell any financial instrument, nor should it be considered a recommendation for any investment. We urge all prospective investors to carefully assess all associated risks before making investment decisions. Please note that any investment carries inherent risks, and prior performance does not guarantee future returns. Before executing any transaction based on the information provided by this website, we strongly encourage investors to take charge of their investment decisions and seek independent advice from business, legal, tax, and accounting advisors regarding investment price, suitability, value, risk, or any other relevant aspects.

The author of The Super Stocks Newsletter has obtained all research and data used on this website from reliable sources. However, it should be noted that the information provided on this website is not intended to be investment advice and does not consider the individual investment requirements or financial situation of any particular investor. Therefore, with a firm commitment to transparency, the author can not guarantee the accuracy, validity, or veracity of any information or data provided on this website for any specific purpose.