Company Outline

Fair Isaac Corporation creates software and technology to help businesses make better decisions. They offer solutions for customer management, fraud detection, and marketing. They also provide scoring solutions for businesses and consumers, including predictive credit scores. Their products include FICO Customer Analytics, FICO Responsible AI, and FICO Business Outcome Simulator, among others. The company sells its products through direct, indirect, and online sales. Fair Isaac Corporation, originally known as Fair Isaac & Company, Inc., was founded in 1956 and is based in Bozeman, Montana.

Perspective and Competitive Edge

Fair Isaac Corporation, known as FICO, dominates the credit scoring industry, providing crucial credit scores to lenders. In 2018, the company changed its pricing strategy, increasing the prices of its scores. FICO earns over $200 million annually from direct sales to consumers and partnerships. The company's software business has been transitioning to the cloud, focusing on the FICO platform and showing strong customer retention and revenue growth.

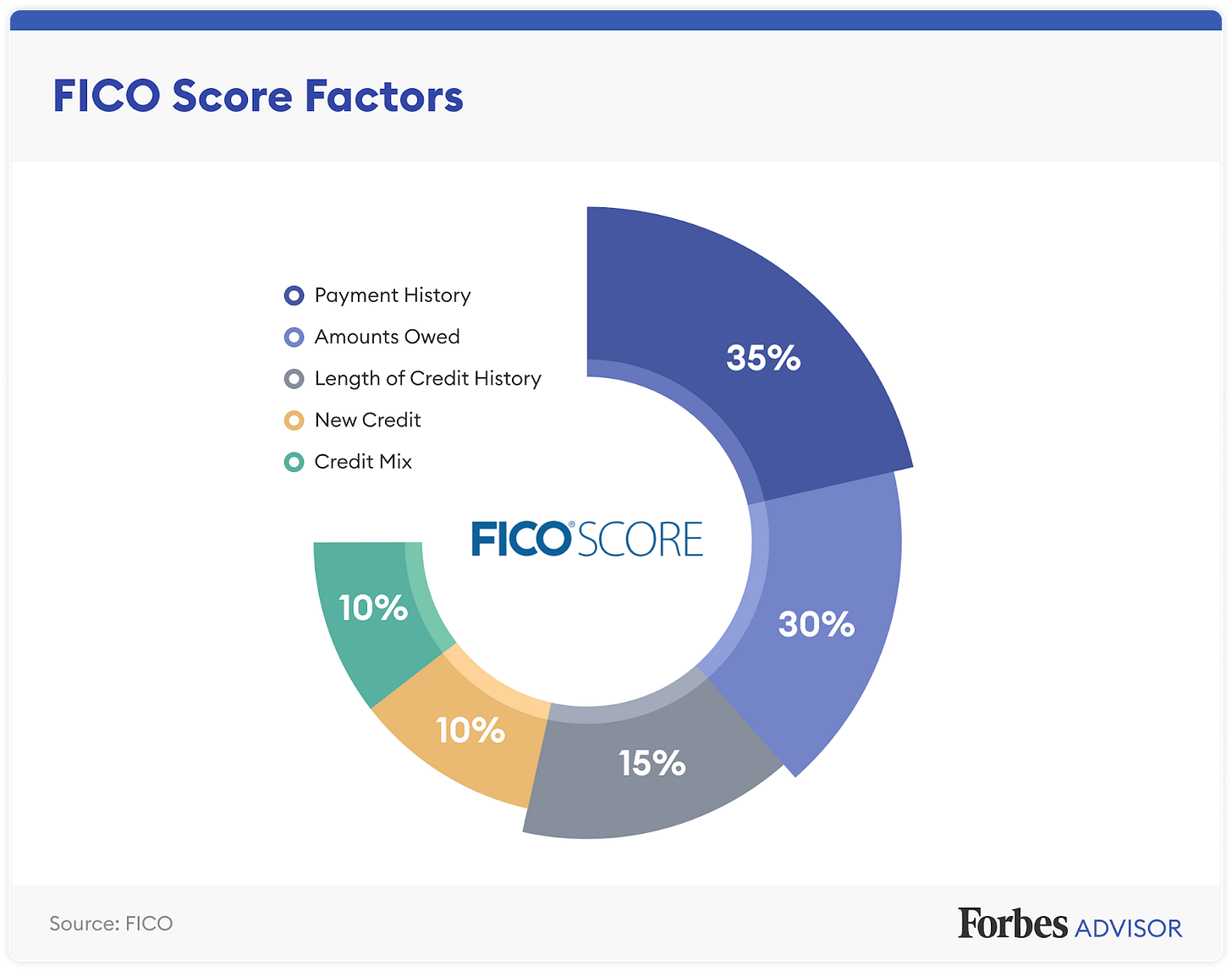

Fair Isaac Corporation relies a lot on its scores segment, making up about three-quarters of its profits, which is the main factor in determining its overall moat rating. The company has a wide moat rating in its scoring segment, mainly because once a credit benchmark like a FICO score is widely adopted, it's hard to replace. FICO scores are used for two primary purposes: making underwriting decisions for individual loans and as a benchmark for credit quality among various stakeholders. Additionally, about one-third of the scores segment revenue comes from its business-to-consumer offerings, including the direct-to-consumer myFICO.com offering.

The Federal Housing Finance Agency is changing the requirements for government-conforming loans. They will now only require reports from two major credit bureaus. They are switching from FICO to include FICO 10T and VantageScore 4.0 for credit scoring. Implementing the new requirement is still ongoing, and it needs to be clarified whether the FICO score and VantageScore will be required from each bureau, totaling four instead of two. This change is positive for VantageScore, but FICO scores will still be necessary. Fair Isaac dominates the market and has a highly scalable business model and significant pricing power. The credit report/score fees are a small part of the total fees paid in the underwriting process.

Fair Isaac's software unit generates about half of the company's revenue but contributes only about one-quarter of its profits. This part of the business provides tools for account origination, customer management, customer engagement, fraud detection, compliance with financial crimes, and marketing mainly to financial institutions.

While FICO has a significant competitive advantage that does not threaten its position, the profit expectation, which is significantly positioned in this segment, may be risky. In addition, the company is in a stable position, ranking among the best companies.

Conjecture and Capital usage

Fair Isaac relies heavily on financial services for 90% of its revenue, making it vulnerable to credit market conditions. The firm experienced a 20% drop in revenue in 2009 compared to 2007, with scoring revenue decreasing by 27% during the financial crisis. Origination volumes of mortgages, auto loans, and credit card loans influence Fair Isaac's business-to-business scoring business. The business-to-consumer scoring unit performs well when consumers are in the market for a mortgage. While the software segment generates recurring revenue, most of the firm's profits come from the scoring business. Geographically, 84% of the firm's income is from the Americas, mainly the United States.

The uncertainty is high due to the wide range of potential pricing outcomes. Fair Isaac's scoring solutions provide value to customers at a relatively low cost, prompting the firm to implement aggressive pricing increases. Fair Isaac is expected to utilize pricing strategies to drive revenue growth. However, accurately predicting the timing and scale of these changes can be complex.

Fair Isaac holds a significant market share from an environmental, social, and governance perspective, which could attract antitrust scrutiny. In March 2020, the Department of Justice initiated an antitrust probe, which concluded in December 2020 without any enforcement action. Additionally, Fair Isaac has faced antitrust complaints from customers, such as credit unions, alleging anticompetitive behaviors. Despite these challenges, the impact on Fair Isaac has been limited, but monitoring this risk is essential.

The company is in good financial shape, makes intelligent investment choices, and has a solid capital management plan. The company's business model only requires it to hold onto a bit of cash, which is a plus.

When it comes to investments, Fair Isaac takes it seriously. Instead of significant changes, the company focuses on smaller deals. Fair Isaac has been using its cash flow and financial leverage to buy back shares, and it's paid off as the share price has gone up. In 2021, the company took the opportunity of a drop in share price to buy back even more shares. Fair Isaac also got rid of its lower-margin collection and recoveries software unit, deciding to concentrate on its other products. That makes sense since that unit only comprised less than 10% of the company's revenue.

The scores segment is the most crucial part. Fair Isaac's decision to stick with its scores business keeps it ahead of the competition. The company stopped paying out a small dividend in 2017, as it was only about $2 million a year.

The company has a very good market position, with a stable market share compared to its competitors. The company's performance and its management of earnings are well thought out and conscious, so it paints a very positive picture for investors and is worth following closely.

Radar

Based on current values, FICO is ranked 1st in the Super Stocks Score rankings.

The Super Stocks Score is like a grade: the average score of five factors. You can see it above the EVA Radar. Companies in the S&P500 are ranked on a scale of 0-100 for each of the five categories based on their performance. The company with the highest Super Stocks Score is considered the best in the market because of its performance, growth, and future potential. Check out the Glossary and the upcoming EVA series to learn more about it.

EVA, or economic value added, measures a company's economic profit. To calculate it, you subtract the capital charge from the company's net operating profit after tax (NOPAT). The capital charge is the cost of giving investors a fair and competitive return on their investment.

EVA Momentum represents the pace of EVA production, EVA Margin represents the ratio of EVA produced to sales, and Sales Growth Rate (SGR) represents year-over-year sales growth. These three factors objectively show the company's profitability in the S&P 500 market.

NOPAT Multiple shows the ratio of NOPAT to the generated market value, and Future Growth Reliance (FGR) shows the future expectation incorporated in the share price. These two factors objectively show the company's perception of the overall market now and in the future.

As the best company in the ranking, no factor prevents it from being above the 90th percentile, so the present and the future look bright. Few companies can be said to have achieved massively in maintaining their current level of performance.

Price expectations

Nine analysts expect the average target price over the next 12 months to be $1274. This is roughly 6% downside potential, meaning analysts consider the stock to be overpriced. This could be based on the extraordinary performance despite the fact that the share price was around $760 a year ago and $550 two years ago, i.e., it has made a big march after a year of stagnation the year before.

I have no position in the company.

The Super Stocks Newsletter is provided for general information only. It should not be construed as an invitation or offer to purchase or sell any financial instrument, nor should it be considered a recommendation for any investment. More: Disclaimer