In this How to series, I will walk you through the basics of investing. As the series progresses, a more detailed and in-depth understanding will be developed so that anyone can start on the path to becoming a conscious investor with the funds they need.

In the first part of the series, we looked at conscious planning, the importance of saving, and the benefits of saving, i.e., investing.

In the second part, I discussed the most critical steps to starting investing: setting up the system and planning, which also include conscious attention to investing.

This section describes the wide range of investment alternatives.

Short of investing

Investing is like planting a seed and watching it grow into a tree, hoping to get more fruits or a taller tree over time. There are many different assets you can invest in, each with its unique characteristics and the potential to bring you a positive return on your investment. So, if you're thinking of investing, just like planting a seed, choosing the right asset to help you grow your wealth is essential.

High or low risk/return

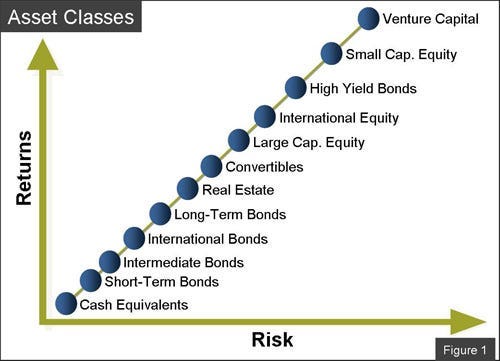

There's a principle called the risk-return tradeoff. It states that the higher the risk, the higher the potential return. If you accept more risk, you can make more money.

Investments come with varying levels of risk and return. CDs are considered low-risk investments, while stocks or equities are riskier. Among the most dangerous investments are commodities and derivatives. You can also invest in practical assets such as land, real estate, or more delicate items like fine art.

Like stocks, even within the same asset class, there can be a vast range of risk and return. A well-known company like Apple will have a different risk-return profile than a small, newly established company known as a 'micro-cap'.

The type of asset you invest in dramatically affects the returns that you can expect to generate. For instance, stocks typically offer quarterly dividend payments, while bonds pay interest quarterly. In addition to regular income, it's important to consider price appreciation as well. Therefore, the total return from your investment can be calculated as the sum of income and capital appreciation.

According to Standard & Poor's, two-thirds of the S&P 500's total equity return since 1926 has come from capital gains, while dividends have contributed to nearly a third. So, capital gains are essential to investing.

Alternatives of investments

The most common types are:

Stocks

When you buy stock in a company, you own a piece of that company. These owners are called shareholders. As a shareholder, you can make money if the company does well - the stock price might go up, or you might get regular payments from the company's profits, which are called dividends.

Bonds

Bonds are financial instruments governments, municipalities, and corporations use to raise funds. When you invest in a bond, you are lending money to the issuer. As a bond investor, you receive periodic interest payments from the issuer as compensation for using your money. When the bond matures, you get back the total face value of the bond.

Funds

Investment funds pool money from investors to invest in stocks, bonds, and commodities. Mutual funds are valued once a day, while ETFs are valued continuously like stocks.

Investment Trusts

Trusts are pooled investments. Real Estate Investment Trusts (REITs) are popular. They invest in commercial or residential properties and pay regular distributions to investors from rental income. REITs trade on stock exchanges, offering instant liquidity.

Options and Other Derivatives

Derivatives are financial instruments that derive their value from other assets like stocks or indexes. An 'options contract' is a popular type of derivative that gives the buyer the right to buy or sell a security at a fixed price within a specific period. Although risky, derivatives can be rewarding.

Commodities

Commodity futures and ETFs are investment options for trading commodities like metals, oil, grains, animal products, financial instruments, and currencies. They involve agreements to buy or sell a specific amount of a commodity at a set price on a future date.

Of course, there are many investment opportunities beyond the ones listed above, but I have tried to briefly list the ones that are available online, in an institutional way. As you can see, there is a wide range, and one of the most important things, among many others, is to consider the risk associated with returns and to know yourself in terms of your risk appetite.

See you next Tuesday for the next episode!