Pepsi Stock Analysis Demystified: All You Need to Know

Cracking Open the Can: Pepsi Stock Analysis Made Simple

How does Pepsi's stock compare to that of its competitors in the beverage industry?

Pepsi's stock performance is robust compared to that of its competitors in the beverage industry. With steady growth, consistent dividends, and a strong brand, PepsiCo stands out with a balanced portfolio of snacks and beverages, setting it apart from others in the market.

Company Overview

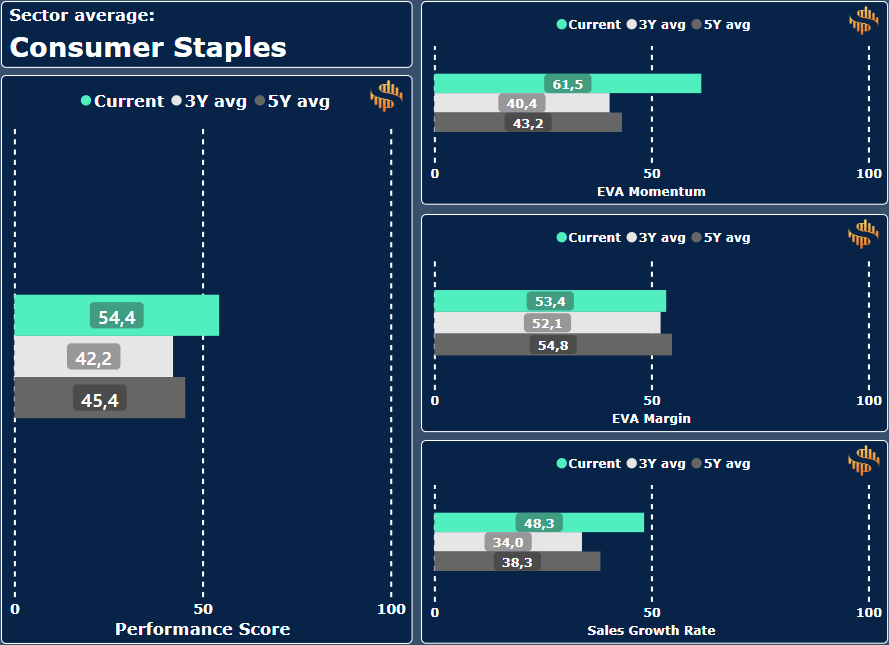

PepsiCo is a global powerhouse in the food and beverage industry, renowned for its iconic brands like Pepsi, Lay's, and Gatorade. With a diverse product portfolio spanning sodas, snacks, juices, and more, PepsiCo caters to a wide range of consumer preferences worldwide. The company faces formidable rivals such as Coca-Cola, Mondelez, and Nestlé in the competitive arena, constantly vying for market share and innovation. PepsiCo has demonstrated resilience despite economic fluctuations, leveraging its substantial brand equity and distribution networks to navigate challenging times. While the Performance Score significantly improves, the Valuation Score has changed in the opposite direction.

Company Outline

Brief information about PEP, PepsiCo Inc. stock analysis

PepsiCo, Inc., is a global company that produces, markets, distributes, and sells beverages and convenient food items.

This company offers various snacks, including dips, cheese-flavored spreads, corn, potato, and tortilla chips. It also provides cereals, rice, pasta, mixes and syrups, granola bars, grits, oatmeal, rice cakes, and side dishes. It has concentrates, fountain syrups, finished goods, ready-to-drink tea, coffee, and juices for beverages. Dairy products are also available. In addition, the company distributes alcoholic beverages under Hard MTN Dew's brand name and sells sparkling water makers and related products.

The company primarily sells its products under its brands like Lay's, Doritos, Fritos, Tostitos, BaiCaoWei, Cheetos, Cap'n Crunch, Life, Pearl Milling Company, Gatorade, Pepsi-Cola, Mountain Dew, Quaker, Rice-A-Roni, Aquafina, Bubly, Emperador, Diet Mountain Dew, Diet Pepsi, Gatorade Zero, Crush, Propel, Dr. Pepper, Schweppes, Marias Gamesa, Ruffles, Sabritas, Saladitas, Tostitos, 7UP, Diet 7UP, H2oh!, Manzanita Sol, Mirinda, Pepsi Black, Pepsi Max, San Carlos, Toddy, Walkers, Chipsy, Kurkure, Sasko, Spekko, White Star, Smith's, Sting, SodaStream, Lubimyj Sad, Agusha, Chudo, Domik v Derevne, Lipton, and other brands.

The company operates through six business segments: Frito-Lay North America (FLNA), Quaker Foods North America (QFNA), PepsiCo Beverages North America (PBNA), Latin America (LatAm), Europe, Africa, Middle East, and South Asia (AMESA), and Asia Pacific, Australia, and New Zealand, and China Region (APAC).

The FLNA segment is responsible for the branded convenience food businesses in the United States and Canada.

The QFNA segment includes cereals, rice, and pasta under the Quaker, Pearl Milling Company, Quaker Chewy, Cap'n Crunch, Life, and Rice-A-Roni brands.

The PBNA segment is responsible for beverage concentrates, fountain syrups, and finished goods under various brands such as Pepsi, Gatorade, Mountain Dew, Diet Pepsi, Aquafina, Diet Mountain Dew, Sierra Mist, and Mug.

The LatAm segment covers the Latin American region's beverage, food, and snack businesses.

The Europe segment offers beverage, food, and snack goods in Europe and Sub-Saharan Africa.

The AMESA segment is responsible for all beverage and convenience food businesses in Africa, the Middle East, and South Asia.

The APAC segment operates all business operations in the Asia Pacific, Australia, New Zealand, and China.

The company provides products to customers such as wholesale and other distributors, food service customers, grocery stores, drug stores, convenience stores, discount/dollar stores, mass merchandisers, membership stores, hard discounters, e-commerce retailers, authorized independent bottlers, and others. The products are distributed through various channels, including direct-store delivery, customer warehouses, and distributor networks. In addition, the company also sells products directly to consumers via e-commerce platforms and retailers.

PepsiCo Inc. was established in 1965 by Donald M. Kendall, Sr., and Herman W. Lay. Its headquarters are in Purchase, NY.

You can follow PepsiCo's short story visually at the following link: Pepsi Story.

Sector and Competitors' view

Which sector does PEP operate in, and against which competitors

Pepsi has a Performance Score that is above the sector average (70.5). The company also has a higher ranking score in each of the factors compared to the sector average. What is EVA?

PepsiCo Inc. is in the Consumer Staples GICS Sector within the Beverages GICS industry. Its competitors include KO (Coca-Cola), General Mills (GIS), Mondelez (MDLZ), Keurig Dr Pepper (KDP), and Monster Beverage (MNST).

In terms of Performance Score (70.5), it can be inferred that the subject entity is in the top category when compared to its competitors. Conversely, when it comes to Valuation Score (26.0), it is notable that most of its competitors are consistently placed in the lower percentile ranges (20-40) apart from Monster. However, it should be noted that despite its high VS value, Monster does not possess a broad economic competitive advantage and is therefore excluded from the scatter plot and the set of firms examined.

Perspective and Competitive Edge

Prospects and the economic moats of the business

Shortly - objective perspective

PepsiCo has faced operational challenges recently, but the management is working hard to address them while dealing with COVID-19 disruptions and inflationary pressures. Despite these challenges, the company has significant growth opportunities due to positive trends in the snack industry and strategies in promising beverage subcategories. We confidently rate the company as having an undeniable wide moat due to exceptional snack and beverage brands, well-established retail relationships, unparalleled scale, and immense bargaining power. Pepsi's snack lineup has the potential to increase its market share significantly, and the company is exploring options to expand its revenue base.

Snacks and beverages are always in demand, even during tough times. PEP has an exceptional supply chain system that provides better control over operations, enabling them to face unforeseen challenges with ease. With a flexible strategy, strong brand recognition, and efficient manufacturing and distribution capabilities, PEP may successfully adapt to changes and improve profitability, making it a promising company.

Having a well-diversified revenue distribution across various business segments and geographical regions is beneficial for a company and its investors as it helps minimize risks. When a company generates revenue from multiple segments and a wider geographic spread, it ensures that any downturn or market fluctuation in one segment or region does not significantly impact the overall financial health of the company. This creates a more stable and sustainable business model, making it an attractive investment opportunity for investors.

Moatology - what the moat is based on the beverage company

PepsiCo boasts a dominant position in the global snacks and beverage industry, enjoying a wide economic moat that surrounds its business. This is primarily due to the company's impressive range of well-known brands that inspire customer loyalty and close relationships with retailers. Additionally, the company benefits from significant scale advantages, including a massive revenue base of $86 billion and global manufacturing and distribution capabilities that provide bargaining power and reduce operational costs. As a result, PepsiCo can deliver investment returns that exceed its capital cost for the next few years, thanks to its intangible solid assets and cost advantage.

PepsiCo is a leading company in the global savory snacks market, valued at $230 billion with a market share of 23%. In 2022, the company invested $5.2 billion in consistent brand development, which is equivalent to 6.0% of its sales, aligned with its competitors. These investments have helped to reinforce the image of these snacks as affordable treats while maintaining healthy volume growth. PEP is committed to innovation, introducing new ingredients and packaging options to cater to consumers' evolving snacking habits and preferences. Its snack brands will continue to dominate the market while maintaining their strong pricing power.

PepsiCo manufactures the second-largest beverage after Coca-Cola and has numerous successful carbonated soft drinks (CSD) and non-sparkling brands. The company manages most of its bottling capacities in-house to better oversee the commercialization process.

PepsiCo has a solid position in the CSD category, but still has potential for growth in emerging markets. The company has strong brand loyalty and has expanded its reach beyond CSDs, achieving growth in sports and energy drinks. Gatorade is a dominant brand in the sports category, with over 40% of the global volume share.

PepsiCo is the third largest player in the energy drink market with an 11% volume share. To increase its market share, the company plans to target specific customer segments with a multi-brand strategy, focusing on Rockstar and Mountain Dew. PepsiCo's licensing of top-volume shares in the ready-to-drink coffee and tea categories from Unilever and Starbucks under the Lipton and Starbucks brands has expanded its beverage lineup, distribution scale, and relationship with retailers.

PepsiCo is an excellent partner for retailers, offering a wide range of popular brands that can increase sales and attract customers to the snack and beverage sections. They have a diverse selection of carbonated and non-sparkling beverages, various snack brands to suit different preferences and budgets, and a technology-driven logistics system. With a revenue base of $86 billion, PepsiCo has substantial bargaining power when it comes to procurement negotiations for various goods and services, such as raw materials and advertising. This approach gives the company the necessary flexibility to ensure that their procurement costs for key ingredients remain a small percentage of their overall expenses.

Performance

Evaluation of economic performance

The Performance Score is calculated as the arithmetic average of 3 factors: EVA Momentum, EVA Margin, and Sales Growth Rate. The values of these factors are based on percentile rankings among S&P 500 companies.

EVA Momentum represents the pace of EVA production, EVA Margin represents the ratio of EVA produced to sales, and Sales Growth Rate represents Year over Year sales growth.

Pepsi’s Performance Score of 70,5 is above-average. It ranks 47th among companies with a wide moat in the S&P 500.

Upon analyzing the company's performance, it can be deduced that it significantly surpasses the Performance Score (PS) average in EVA Momentum with a score of 83.1. Additionally, the company marginally outperforms PS in EVA Margin with a score of 74.0. However, the company's Sales Growth Rate, with a score of 54.4, places it in the middle of the pack among S&P 500 companies. Considering the company's life cycle, a significant increase in Sales Growth Rate is not anticipated. Nevertheless, it is noteworthy that a significant decline is also not expected.

Conjecture and hesitancy

Factors Threatening the Activity

The food and beverage industry faces numerous risks and uncertainties that threaten to disrupt pricing structures and consumption patterns. E-commerce and hard discounters have introduced more competition into the market, while health awareness has driven shifts in consumer behavior. Additionally, regulations and taxes aimed at reducing plastic packaging and unhealthy ingredients such as sugar, sodium, and saturated fat further complicate the industry's landscape.

With the rise of smartphones and social media, consumers are closely scrutinizing food and beverage brands. Any perceived inconsistency in messaging, consumer experience, social practices, or sustainability efforts could result in brand damage and a subsequent decline in demand and pricing power.

PepsiCo's exposure to international markets with varying economic and demographic trends presents significant challenges. The company must quickly adapt to an ever-evolving operating environment and address issues such as cost inflation, labor relations, and geopolitical unrest. While the majority of its revenues are generated in the USA and Canada, PepsiCo remains vulnerable to global headwinds.

Growing health awareness among consumers poses another challenge for PepsiCo, which must balance taste appeal with health considerations. Efforts to reformulate and modify recipes are ongoing, yet consumer concerns regarding the health impact of savory snacks and beverages may persist. PepsiCo's attempts to address these concerns may become cost-prohibitive and impact margins.

Capital usage and resharing

Use and reallocation of capital, investments, and dividend

PepsiCo has established a strong financial position and a track record of generating long-term value through strategic investments, while also prudently allocating shareholder benefits through cash dividends and share repurchases. The company's financial health is reflected in its robust balance sheet and decreasing net debt, which provide a solid foundation for sustainable growth. With a solid cash position and the potential to generate strong free cash flow, PepsiCo has the ability to withstand external shocks and support its growth strategies.

The company's heavy investment in its snack brand portfolio, distribution system, and research and development has resulted in solid organic growth and further solidified its global dominance in the highly attractive snack business. With a market share nine times larger than its closest competitor, PepsiCo is well-positioned to capitalize on emerging opportunities in the market.

Under the leadership of current CEO Ramon Laguarta, the company has increased its investment in refreshing core brands and introducing healthier options to cater to the growing health-conscious crowd, rectifying a period of underinvestment in the beverage business.

Mergers and acquisitions have long been a part of PepsiCo's growth strategy, with notable successes such as the acquisition of Quaker Oats in 2001, which gave the company the dominant sports drink brand Gatorade and a long runway of growth in the non-sparkling category. The more recent acquisitions of Pioneer Foods, Be & Cheery, and Rockstar, though smaller in size, align with the company's strategic profile and provide exposure to attractive categories such as energy drinks, nuts, and seeds, as well as attractive emerging markets such as Africa and China.

Returning cash to shareholders

On shareholder distributions, PepsiCo has returned cash to shareholders consistently with a combination of cash dividends and share buybacks. It maintained a payout ratio averaging more than 70% over the past three years, with dividends per share growing at an average of 6% yearly.

Management should only consider buybacks when the stock trades below its intrinsic value, without committing to a yearly target at a fixed amount. Buybacks have fluctuated year to year, which seems prudent.

Valuation synopsis

Value assessment from multiple perspectives, analysts' forecast

According to Tipranks, 17 Wall Street analysts forecast price targets, and the share price is roughly 11% lower than the average analyst expectation.

The Valuation Score is the arithmetic average of two factors: NOPAT Multiples, which shows the ratio of NOPAT to Market Value generated, and Future Growth Reliance, which shows the future expectation incorporated in the share price.

While the Performance Score reflects positively on the company, the Valuation Score seems comparatively lower and has a declining trend. It is in the lower region compared to the overall market. This suggests that the company's perception of the future can be described as moderate.

Short & Sweet

Preliminary assessment based on the complete picture

Based on current values, Pepsi is 96th in the Super Stocks Score rankings.

The Super Stocks Score, shown above the EVA Radar, is the average percentile score of the five factors used and presented in the analysis. Companies in the S&P500 are ranked on a scale of 0-100 in each of the five categories based on their actual performance, and the company with the highest Super Stocks Score is considered the best in the market based on performance, growth and future expectations. For more information, see the Glossary and the forthcoming EVA series.

Help and more information to understand the concepts: Glossary.

Link to: Disclaimer

The Super Stocks Newsletter is provided for general information only. It should not be construed as an invitation or offer to purchase or sell any financial instrument, nor should it be considered a recommendation for any investment. We urge all prospective investors to carefully assess all associated risks before making investment decisions. Please note that any investment carries inherent risks, and prior performance does not guarantee future returns. Before executing any transaction based on the information provided by this website, we strongly encourage investors to take charge of their investment decisions and seek independent advice from business, legal, tax, and accounting advisors regarding investment price, suitability, value, risk, or any other relevant aspects.

The author of The Super Stocks Newsletter has obtained all research and data used on this website from reliable sources. However, it should be noted that the information provided on this website is not intended to be investment advice and does not consider the individual investment requirements or financial situation of any particular investor. Therefore, with a firm commitment to transparency, the author can not guarantee the accuracy, validity, or veracity of any information or data provided on this website for any specific purpose.