Johnson and Johnson Stock Value: Key Findings

Where Health Meets Wealth - Essential Findings Revealed

How does Johnson and Johnson stock value compare to its competitors in the healthcare industry?

Johnson & Johnson's stock value is considered stable and reliable compared to that of its competitors in the healthcare industry. With a strong track record of innovation and diversification, J&J has consistently outperformed many others in terms of stock value and market stability.

Company Overview

In the realm of investment, JNJ emerges as a distinguished participant in the healthcare sector, with a vast and diverse product range, and a well-established track record of paying dividends. It is noteworthy, however, that the company is not positioned as a high-growth entity, which warrants a prudent evaluation from the perspective of an investor. As such, assessing the company's financial performance and market trends is crucial to determine its investment potential.

Company Outline

Brief information about Johnson&Johnson

Johnson & Johnson is a holding company that develops, manufactures, and sells healthcare products worldwide. The company operates in three segments: Consumer Health, Pharmaceutical, and MedTech.

The Consumer Health segment includes products focused on personal healthcare used in various markets, such as Skin Health/Beauty, Over-the-Counter medicines, Baby Care, Oral Care, Women's Health, and Wound Care.

The Innovative Medicine segment offers products for various therapeutic areas, such as immunology, infectious diseases, neuroscience, oncology, cardiovascular and metabolism, and pulmonary hypertension. These products are sold for prescription use through retailers, wholesalers, distributors, hospitals, and healthcare professionals.

The MedTech segment provides Interventional Solutions, including electrophysiology products to treat heart rhythm disorders, technologies to treat severe coronary artery disease requiring high-risk PCI or AMI cardiogenic shock, and neurovascular care that treats hemorrhagic and ischemic stroke. Additionally, the segment offers an orthopedics portfolio that includes products and enabling technologies that support hips, knees, trauma, spine, sports, and others; surgery portfolios comprising advanced and general surgery technologies and solutions for breast aesthetics, ear, nose, and throat procedures. The segment also offers contact lenses under the ACUVUE Brand and TECNIS intraocular lenses for cataract surgery.

The company distributes its products to wholesalers, hospitals, retailers, physicians, nurses, and clinics, including eye care professionals.

It was founded by Robert Wood Johnson I, James Wood Johnson, and Edward Mead Johnson Sr. in 1886 and is based in New Brunswick, NJ.

You can follow Johnson&Johnson's short story visually at the following link: Bigger than you know - JNJ.

Sector and Competitors' view

Which sector does it operate in, and against which competitors

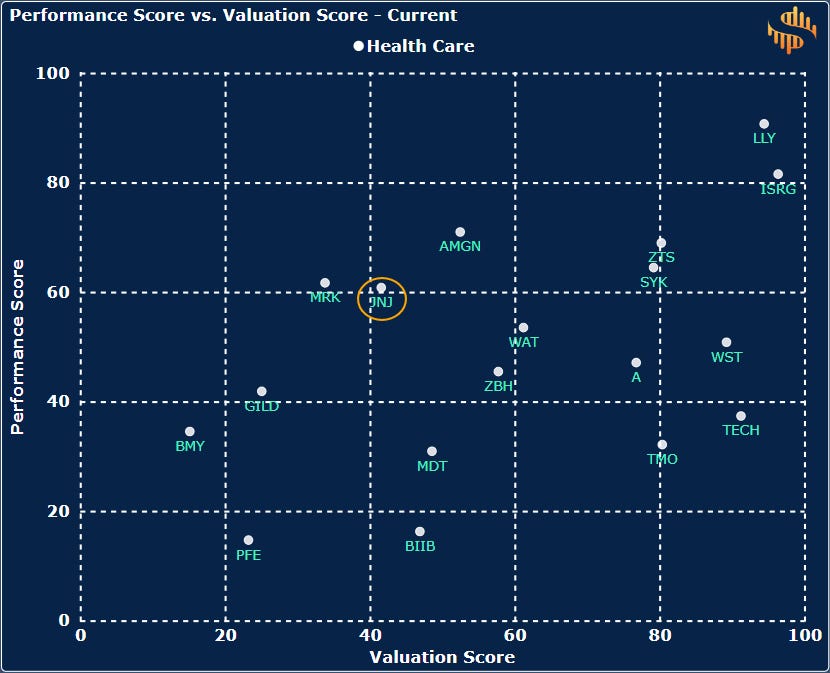

Johnson & Johnson's current score (60.8) is above the sector average, but this was not the case in the previous periods under review. The trend is positive; the question for the future is whether it can be sustained, as the company is characterized by long-term predictability and stability rather than steep upward growth. What is EVA?

Johnson&Johnson is in the Healthcare GICS Sector within the Pharmaceuticals GICS industry. Its competitors include Lilly & Co. (LLY), Merck (MRK), and Procter&Gamble (PG).

Perspective and Competitive Edge

Prospects and the economic moats of the business

Shortly - objective perspective

Johnson & Johnson's position as a healthcare leader is widely recognized owing to its diverse revenue base, ongoing research initiatives, and impressive cash flow.

Johnson & Johnson, or JNJ, is a leading healthcare company with a strong presence in various healthcare industry segments, including medical devices, consumer healthcare products, and multiple pharmaceutical markets. The pharmaceutical division, which accounts for nearly 50% of the company's total revenue, boasts an impressive portfolio of industry-leading drugs such as Stelara and Tremfya for immunology and Darzalex and Imbruvica for cancer. With a global reach and a diverse range of products, JNJ has a competitive edge in the healthcare industry.

The medical device group contributes to almost one-third of the company's sales. Johnson & Johnson holds controlling positions in several areas, including orthopedics and Ethicon Endo-Surgery's surgical devices. The consumer division provides additional business lines, but the company has planned to divest its consumer healthcare group, Kenvue. A partial divestment of approximately 10% of Kenvue took place in May 2023, and the remaining divestment is scheduled for later in 2023, enabling the company to focus more on drugs and devices.

J&J is making remarkable progress in its research and development endeavors, leading to the creation of next-generation products. The pharmaceutical industry has recently witnessed several new blockbusters launched by the company. However, J&J aims to increase the number of significant drugs in late-stage development to fuel long-term growth. The company has also introduced innovative medical devices, such as contact lenses, minimally invasive surgical tools, and robotic instruments, to revolutionize the healthcare industry.

The company's diversified operating segments and the anticipated launch of new products offer protection against patent losses that are potentially stronger than many other pharmaceutical giants.

The revenue distribution is also well diversified by business segment and geographical exposure. It is preferable to have revenues from more than one business segment and a better geographical spread, thus reducing the risk for the company and, thus, for the investor.

Moatology - what the moat is based on in the leading healthcare company

Johnson & Johnson is renowned for having one of the widest moats in the healthcare sector. This is primarily due to its substantial intellectual property in the drug group, switching costs in the device segment, and robust brand power in the consumer group.

The company's diverse revenue base, strong pipeline, and robust cash flow generation create a vast economic moat, which is highly appreciated by the industry. J&J's extensive salesforce makes it a powerful partner for smaller biotechnology companies looking to collaborate on new drugs, further strengthening Johnson & Johnson's ability to bring new products to market.

Johnson & Johnson's diverse operations are a significant factor in supporting its wide moat. The company has a leadership role in several segments, including medical devices, OTC medicines, and drug markets. Additionally, the company is not overly dependent on one particular operating segment, which mitigates the risk of over-reliance. Within each segment, no one product dominates sales, which is a testament to the company's commitment to providing value to its customers.

Johnson & Johnson maintains a solid market competitive position despite having some lower-margin divisions. The firm's pricing power remains strong, and it has consistently posted gross margins above 70% during the past four years.

The company's R&D efforts are aimed at supporting its robust revenue base. Johnson & Johnson has recently launched several new blockbusters in the pharmaceuticals segment, which should help it avoid significant impact from upcoming patent expirations.

In the medical devices segment, the company's focus on robotics and digital data is expected to help it maintain leadership in several areas. Additionally, high switching costs associated with some of its device products will likely keep physicians tied to the company's offerings.

On the consumer side, Johnson & Johnson's solid brand power, combined with new product advancements and marketing campaigns, is expected to help maintain solid pricing power.

Performance

Evaluation of the economic performance of JNJ

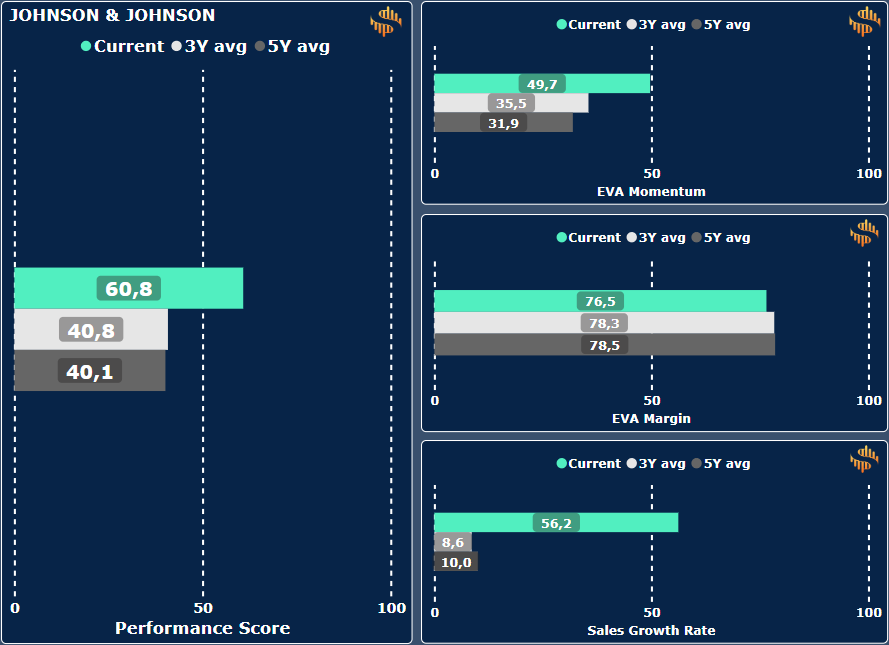

The Performance Score is calculated as the arithmetic average of 3 factors: EVA Momentum, EVA Margin, and Sales Growth Rate. The values of these factors are based on percentile rankings among S&P 500 companies.

EVA Momentum represents the pace of EVA production, EVA Margin represents the ratio of EVA produced to sales, and Sales Growth Rate represents Year over Year sales growth.

Johnson&Johnson ranks 77th in the S&P 500 in Performance Score Current rating. There has been a significant improvement in the average performance score in recent years, which was just above the 40th percentile and currently above the 60th percentile (60.8). Looking at the drivers individually, there has been an increase in EVA Momentum, particularly in Sales Growth Rate. At the same time, the company has maintained its position in the top quartile for EVA Margin.

Such significant progress in SGR could be disappointing, as the 2021-2022 results reflect a substantial drop in sales (-14.7%) and a consequent drop in EVA generated (-33.4%). Since then, sales have rebounded, although they have not reached their historical levels. However, the increase in EVA has not followed the resumption of sales growth. The EVA Margin, however, shows that the company has a stable outperformance in the market based on the ratio of EVA produced to Sales. Again, it is important to stress that the values show market ranking, i.e., worse performance of competitors compared to the company being evaluated may result in an improvement. In my opinion, the companies that are the best performing are essential, so ranking is what shows this.

Conjecture and hesitancy

Factors threatening the activity of the fintech giant

The company is currently facing several challenges related to environmental, social, and governance risks. One of the primary concerns is the potential policy reforms in the US regarding drug prices. The reforms aim to increase drug access by lowering prices, which could significantly impact the company's sales as nearly 30% of its total sales come from US prescription drug sales.

Moreover, the company faces product governance issues, including side effects and patent litigation, which may affect the company's reputation and sales. Apart from these issues, the company is also exposed to typical healthcare risks such as regulatory delays, non-approvals, and reduced pricing power from governments and pharmacy benefit managers. Additionally, the company faces increasing competition from generic drugs for both small molecules and biologics.

The company's broad portfolio of products could mitigate these risks. However, it needs to overcome several legal roadblocks, including ongoing litigation surrounding the central nervous system drug Risperdal, talcum powder, surgical mesh products, and opioid drugs. Although some of these cases are nearing their end, additional hurdles can still arise, leading to significant settlements and potential damage to the company's reputation.

The company's most considerable risk is access to essential services tied to drug pricing. With nearly one-third of its total sales coming from US prescription drug sales, the company is slightly lower than its peers. Any major pricing reforms could significantly impact the company's sales and margins. Therefore, the company must carefully manage this risk while addressing its other challenges.

Capital usage and resharing

Use and reallocation of capital, investments, and dividend

The capital allocation of Johnson and Johnson is in a favorable position, with a sound balance sheet, a reasonable track record of investments, and fair shareholder distributions.

J&J's strong balance sheet, with low levels of risk, including the size of the debt carried, business cyclicality, and debt maturity outlook, is commendable. While some argue for increasing leverage to be more active in investing, the company and most firms in the large-cap biopharma industry should maintain ample balance sheet strength to support opportunistic acquisitions as dynamic scientific data emerges. A strong balance sheet also helps biopharma firms navigate most product litigation challenges with minimal concern from the market.

As for investments, J&J is operating at a reasonable level. The company spends over 20% of sales on R&D for the drug business, which is above the industry average of high teens, and close to 9% of sales on R&D for the device business, which is close to the industry average of 8-9%. The company has shown high productivity with solid execution in drug pipeline development, yielding enough new drugs to help mitigate patent losses. The firm productivity in new innovative medicines, particularly in oncology and immunology, fortifies the firm's wide moat and expands the returns on invested capital. However, innovation in the device segment needs to catch up with peers in the orthopedic space, particularly in robotic developments.

On the acquisition side, J&J has executed reasonably well. The largest recent acquisition of Actelion for close to $30 billion brought in a crucial rare disease franchise where pricing power looks strong. However, we need clarification on whether the acquisition will create much value due to the high price point paid for the firm. Additionally, the $6 billion acquisition of Momenta Pharmaceuticals looked relatively expensive but favorable on the pipeline development side.

Returning cash to shareholders

Regarding distributions, J&J's dividends and share repurchases look appropriate. Thanks to solid cash generation, J&J has a long history of consistently raising its dividends, enabling the firm to increase its dividends over the past half-century and giving investors high confidence in the business. Further, the firm can fund internal solid investments while supporting the dividend and some moderate, well-timed share repurchases over the past several years.

Valuation synopsis

Value assessment from multiple perspectives, value of Johnson and Johnson stock

According to 13 analyst price targets, the share price is roughly 14% lower than the average analyst expectation.

The Valuation Score is the arithmetic average of two factors: NOPAT Multiples, which shows the ratio of NOPAT to Market Value generated, and Future Growth Reliance, which shows the future expectation incorporated in the share price.

The Johnson&Jonhson Valuation Score is below the S&P500 average, ranking just above the 40th percentile. Future Growth Reliance scores slightly higher, holding steady around the 45th percentile each period. The NOPAT Multiple is in the 35th percentile range in each period with a minimal downward trend, so the average of the two indicators gives the VS a value slightly above 40. The stock is not seen to be growing at a higher EVA than previously, nor is the NOPAT performance reflecting this. Still, it is important to stress that the company is not known for its growth numbers but primarily for its stability. As an investor an investor who chooses the company will get a very stable pillar.

Short & Sweet

Preliminary assessment based on the complete picture

Johnson and Johnson is a traditional, reliable company that, if sufficiently diversified and spending a lot on R&D, can be a stable portfolio component from a dividend point of view. However, there are also much better growth targets, which correlate with higher performance, so it depends on the investment objective and time horizon for whom it may be an ideal choice.

Based on current values, Johnson&Johnson is 99th in the Super Stocks Score rankings.

The Super Stocks Score, shown above the EVA Radar, is the average percentile score of the five factors used and presented in the analysis. Companies in the S&P500 are ranked on a scale of 0-100 in each of the five categories based on their actual performance, and the company with the highest Super Stocks Score is considered the best in the market based on performance, growth and future expectations. For more information, see the Glossary and the forthcoming EVA series.

Help and more information to understand the concepts: Glossary.

Link to: Disclaimer

The Super Stocks Newsletter is provided for general information only. It should not be construed as an invitation or offer to purchase or sell any financial instrument, nor should it be considered a recommendation for any investment. We urge all prospective investors to carefully assess all associated risks before making investment decisions. Please note that any investment carries inherent risks, and prior performance does not guarantee future returns. Before executing any transaction based on the information provided by this website, we strongly encourage investors to take charge of their investment decisions and seek independent advice from business, legal, tax, and accounting advisors regarding investment price, suitability, value, risk, or any other relevant aspects.

The author of The Super Stocks Newsletter has obtained all research and data used on this website from reliable sources. However, it should be noted that the information provided on this website is not intended to be investment advice and does not consider the individual investment requirements or financial situation of any particular investor. Therefore, with a firm commitment to transparency, the author can not guarantee the accuracy, validity, or veracity of any information or data provided on this website for any specific purpose.